Looking Back on 2022: A Round-Up of Research on Tobacco from Latin America

Our think tank partners across Latin America continued to produce research throughout 2022 and we summarize these findings below. Overall, the evidence shows that tobacco use continues to harm the region due to ineffective tobacco taxation. Aligning these policies with evidence-based best practices in tobacco taxation is essential to reducing the substantial harm caused by smoking, while raising additional revenue.

In Argentina, findings from the Centro de Estudios, Distributivos, Laborales y Sociales (CEDLAS) affirm that tobacco taxes are the most cost-effective policy option for tobacco control. Significantly raising tobacco taxes that lead to a price increase of 18% would decrease tobacco use by 12%. Unlike other tobacco control policies, tax increases require minimal administrative costs to implement. The research also shows that pairing such a tax reform with other non-tax measures would maximize the effectiveness of these strategies due to the signaling effect between policies.

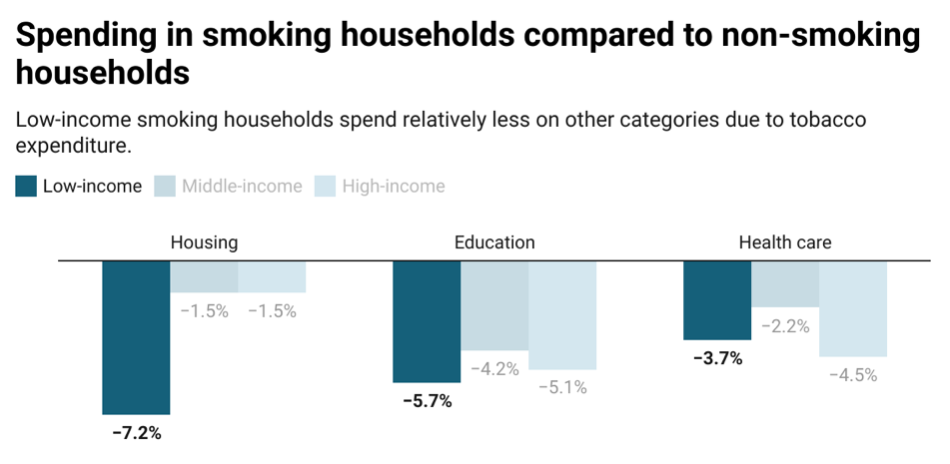

Tobacco taxes have the potential to improve the livelihood of the poorest segments of the population. Centro de Investigación Económica y Presupuestaria A.C. (CIEP) found that tobacco use has a profound effect on household budgets in Mexico, especially among low-income households. Smoking households spend less on health care, education, and housing relative to non-smoking households and simultaneously spend more on other harmful products, such as alcoholic beverages. The decreased expenditure on health care and education spending, especially, can have long-term negative consequences for members of the households. Furthermore, spending money on tobacco leaves over 900,000 more Mexicans with a disposable income below the extreme poverty line, worsening the wellbeing of the country’s most vulnerable households.

At the same time, evidence from Centro de Investigación en Alimentación y Desarrollo (CIAD) shows that low-income smokers are most responsive to price increases compared to other income groups. Increasing the price by 1 peso per stick — a nearly 70% price increase — would reduce consumption by 40% among low-income smokers compared to a 33.6% reduction in consumption among high-income smokers. A large increase in the specific component of the excise tax on cigarettes would also improve equity by reducing the gap in taxes paid by low- and high-income smokers. This shows that tobacco tax increases are not regressive or harmful to the poor.

Unfortunately, cigarette manufacturers effectively discourage tax increases with the threat of the illicit market. This is especially relevant in Brazil, which struggles with a continued influx of illicit cigarettes from neighboring countries, particularly Paraguay. Universidade Católica de Brasília (UCB) estimates the cross-price elasticities of licit and illicit cigarettes, and shows that a 10% increase in licit cigarette prices would reduce overall consumption by 4.1% without increasing consumption of illicit cigarettes. Raising tobacco taxes, therefore, would not impact illicit trade. The researchers also note that the minimum legal price of BRL 5 per pack has not been updated since 2016. As a result, it is no longer a useful tool to distinguish between the licit and illicit market, and cigarettes in both markets are being sold at similar prices. These findings suggest that policy makers can raise tobacco taxes as well as the minimum legal price without major increases in illicit trade, though they should nonetheless continue to strengthen tax administration and border control efforts to tackle this challenge.

In countries around the region, there is significant opportunity to implement strategies that are known to discourage tobacco use and raise additional tax revenue. While the industry makes opposing claims, their arguments are unsubstantiated by the high-quality research presented by independent researchers in the region. Raising tobacco taxes benefits the entire population, and especially the poorest households in Latin America.